dhartmann34

Well-known member

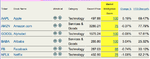

Buffet's company has actually under performed the S&P 500 over the past 10 years or so.I'm talking the people that RUN the companies and the stock brokers shorting because they know a helluva lot more than you and I.

It's easy to make money when you make the laws and rules and know what's coming. Why do you think they call Buffet the "Oracle of Omaha?"

That's how they do it. THEY know when to short. I don't advise it for you and I.

And what's with Apple? I never even mentioned Apple, so no idea what you are getting at mr tin foil.

Sent from my SM-G975U using Tapatalk