Carolina Golfer

Well-known member

- Joined

- May 11, 2017

- Messages

- 2,600

- Reaction score

- 1,319

- Handicap

- 36

What happens to the stock market if Biden wins? With Trump, it should remain strong, no? Not trying to be political at all, just financial.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Unfortunately with the nature of the question being 100% political, we are going to kindly ask that it not continue.What happens to the stock market if Biden wins? With Trump, it should remain strong, no? Not trying to be political at all, just financial.

I guess your buying now.Buy low, sell high.

I had my meeting today to go over portfolio. Not doing to bad, just need to stay the course.

The ramifications to the economy from COVID and rampant government spending have not hit yet. I predict ugliness in 2021 and a big, longer term correction.

Think you called this one....Apple stock is ripe for a pullback with it’s P/E ratio way higher than it has ever been. It’s P/E has mostly hovered in the teens the last two decades since I’ve been following (and trading) the stock and it is now in the mid 30’s. I’ll never understand the stock market and how it values stocks, lol. Apple has tripled in price since January of 2019, a nearly impossible rise in price for a such a large CAP stock. I’m shocked that it reached $2 Trillion in value so quickly.

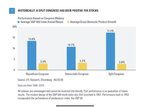

View attachment 8961823

What's a better value, more stock or a second vacation home at Myrtle Beach? If the stock tanks, the money evaporates. If the housing market tanks, you still have a house, no? My wife says, but, you have new monthly expenses on a house, too. Thoughts? What's a good argument to buy the condo?

What's a better value, more stock or a second vacation home at Myrtle Beach? If the stock tanks, the money evaporates. If the housing market tanks, you still have a house, no? My wife says, but, you have new monthly expenses on a house, too. Thoughts? What's a good argument to buy the condo?

I’ve done a fair bit of digging on Wells Fargo because I thought I liked the price but it seems that they are the worst positioned bank of the major ones. I invested in the rest of them and left WF on the sidelines. Time will tell if I’m right but it’s what I did.I work in the wholesale automotive industry for a major auction company. Im seeing the signs and the expectations of many of our commercial clients. We are expecting an incoming tide of reposessions next year when payment protection legislation ends.

Now I am trying to figure out how to position myself in the stock market to take advantage. Companies like Carvana, Shift, Vroom are set to take a bigger share of the auto sales industry next year, but their revenue doesnt come from repos.

I could invest in auction companies like KAR, Manheim or others. KAR is down 50% on their share prices from late last year.

Anyone have perspective on investing in bank stocks like wells fargo, chase etc who will be dealing with most of these repos? Is that even the way to go? Technically, a bank repo is a liability for the bank and they are trying to cut their losses with it. So it might not be wise to invest in that...

So if I read your post correctly, the current boom in the Used Car market could be fleeting if Repo's hit the market.I work in the wholesale automotive industry for a major auction company. Im seeing the signs and the expectations of many of our commercial clients. We are expecting an incoming tide of reposessions next year when payment protection legislation ends.

Now I am trying to figure out how to position myself in the stock market to take advantage. Companies like Carvana, Shift, Vroom are set to take a bigger share of the auto sales industry next year, but their revenue doesnt come from repos.

I could invest in auction companies like KAR, Manheim or others. KAR is down 50% on their share prices from late last year.

Anyone have perspective on investing in bank stocks like wells fargo, chase etc who will be dealing with most of these repos? Is that even the way to go? Technically, a bank repo is a liability for the bank and they are trying to cut their losses with it. So it might not be wise to invest in that...

So if I read your post correctly, the current boom in the Used Car market could be fleeting if Repo's hit the market.

A flood of used cars would lower prices correct?

They are both risk and return investments in my mind. Historically will have data.

Next year could change the market quite a bit.

Myrtle Beach has been on the low side of costs for a while, compared to other beach area options. One note with the condo is the monthly fees that come along with that. I don't mean typical home expenses, but association fees that usually include maintenance and external building insurance.

Thx, JB. Good point on the association fees. That part is a concern. It can go much higher than expected.

Anyone have perspective on investing in bank stocks like wells fargo, chase etc who will be dealing with most of these repos? Is that even the way to go? Technically, a bank repo is a liability for the bank and they are trying to cut their losses with it. So it might not be wise to invest in that...

I think we are going to continue to see a very mixed bag moving forward especially if no further stimulus is passed before 2021 and based on how the election is forecasting that won't happen. If stimulus is passed then the continued recovery will gain steam and move forward. If nothing else is passed we will have a long slow recovery just like 2008 and on. If the federal government helps the states and we don't increase taxes on corporations it could be a robust recovery. Unfortunately with both Presidential candidates it seems we are going to get one of those 2 things instead of both.

|