probably in regards to the perception of how a stock is valued...I am curious what you mean by that?

We've launched the new forums! Read more here

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cryptocurrency - Bitcoin & others..

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

bobgeorge

Kentucky Wildcat Fan!

Once the US lawmakers can get their heads out of their asses and create a logical framework for digital asset regulation, bitcoin ETFs and other investment vehicles will finally be approved in the US like they have been in many other countries and institutional and other mainstream adoption will increase even more than it is already. Its just a matter of time and once the halving occurs next April price momentum should trend higher again. Not that 60-65% gains YTD are anything to shake a stick at.

I agree. Our lawmakers need quit having hearings & actually do something. The U.S. is falling further and further behind to Asia and Europe.

bobgeorge

Kentucky Wildcat Fan!

I kind of agree with you, but is kind of similar to a house. Most houses in the U.S. probably rose in value by 20% in the past 3-4 without an owner making any improvements. Actually owners were selling houses as-is when buyers could see there was issues they were going to have to put $$$ into.I am still fascinated by the fact, it is only increasing in value because people buy it. Not because there is a well managed business increasing their sales of goods and services.

uitar99

Well-known member

I hear you. The house itself produces nothing. It just provides shelter and safety.I kind of agree with you, but is kind of similar to a house. Most houses in the U.S. probably rose in value by 20% in the past 3-4 without an owner making any improvements. Actually owners were selling houses as-is when buyers could see there was issues they were going to have to put $$$ into.

But folks in North America don't want to live in tents they produce by killing a buffalo. Between Folks being born and immigration, there is a real demand.

Investors want to make profits. Crypto currency is just that. A currency. Its favour seems to be increasing because investors are getting younger and do more online. Its an electronic currency...so it must be a good investment. It is, as long as people keep buying it. But on its own, it does nothing.

I am not an expert but Block chain seems to be "something". It can be used to control , say, contracts. Invest in block chain if it becomes a useful product.

uitar99

Well-known member

I acknowledge, all investments have risk. Safer risk investments generally have some type of legal goods or service you can touch.I am curious what you mean by that?

I just can't my head around Crypto as a longer term safer investment. It just goes up and down based on people buying or selling, or large crypto banks failing miserably

Sure, folks can use crypto to enter illegal activity and block chain hides the transaction. But even there, your not sure the seller is going to mail you the cocaine.

uitar99

Well-known member

Exactly.

Some folks will hit home runs and make a killing.

The masses will not.

The home run hitters are no different than mining speculators...they will be out before the bore holes are empty...they need the masses to buy to drive prices up.

Some altcoins have not followed bitcoins rise in the past month. I believe they will rise in value slower than bitcoin but will offer some nice gains in the near future "if" bitcoin etf's become reality. I am buying 16 different coins this morning.

though I have made an investment in Bitcoin, Cardano, and Polygon. I resist adding because I fail to find the underlying asset value.Some altcoins have not followed bitcoins rise in the past month. I believe they will rise in value slower than bitcoin but will offer some nice gains in the near future "if" bitcoin etf's become reality. I am buying 16 different coins this morning.

demand (adoption and usage) is the only driver. With the spot bitcoin EFT "dumb money" will only drive the price until they smarten up.

Blackrock will make a short term killing maybe 24 months.

I share your sentiment. Maybe I’m old or too risk adverse but I’d have a hard time putting any meaningful amount of my retirement nest egg in bitcoin. I’m with Buffett on this one. I’d be happier and sleep better with 50% of my nest egg in Brk.b than 5% of it in Bitcoin or other Cryptocurrency.I acknowledge, all investments have risk. Safer risk investments generally have some type of legal goods or service you can touch.

I just can't my head around Crypto as a longer term safer investment. It just goes up and down based on people buying or selling, or large crypto banks failing miserably

Sure, folks can use crypto to enter illegal activity and block chain hides the transaction. But even there, your not sure the seller is going to mail you the cocaine.

I still have too much in the FAANG stocks but they have done so well the last 15+ years it’s hard for me to not like them.

Buffet hated Apple not long ago tooI share your sentiment. Maybe I’m old or too risk adverse but I’d have a hard time putting any meaningful amount of my retirement nest egg in bitcoin. I’m with Buffett on this one. I’d be happier and sleep better with 50% of my nest egg in Brk.b than 5% of it in Bitcoin or other Cryptocurrency.

I still have too much in the FAANG stocks but they have done so well the last 15+ years it’s hard for me to not like them.

Everything but bitcoin is garbage. A spot bitcoin etf is all but imminent now which is most of what's driving the price up recently. Once it happens and the general public actually have a real, uncomplicated means of investing in it, including in their 401Ks, it will drive even more widespread adoption of it as a store of value.Some altcoins have not followed bitcoins rise in the past month. I believe they will rise in value slower than bitcoin but will offer some nice gains in the near future "if" bitcoin etf's become reality. I am buying 16 different coins this morning.

Yep, he hated all tech stocks for a long time and never invested in companies he didn't understand. He didn't buy IBM until 2011 or Apple until 2016 but when he finally did buy Apple they were the most profitable company in the U.S. I think he looks at them as a retail company with a huge following that he can understand.Buffet hated Apple not long ago too

But there is still no way to value it like an investment. It's currencyEverything but bitcoin is garbage. A spot bitcoin etf is all but imminent now which is most of what's driving the price up recently. Once it happens and the general public actually have a real, uncomplicated means of investing in it, including in their 401Ks, it will drive even more widespread adoption of it as a store of value.

It will ultimately be played like the the forex waiting for 5 basis point moves. you'll have to play it leveraged. it won't be for the regular investor. And it definitely should not be in someone's IRA/401k with all the "unconscious" deposits from your parents, kids, neighbors, and every other unsavvy person who knows "I have to put my money in here for later, I'm just going to put in the 2065 fund."

That's really not entirely accurate. You should read more about itBut there is still no way to value it like an investment. It's currency

That's really not entirely accurate. You should read more about it

I think companies like FTX and the SEC suing other crypto exchanges/companies is giving a lot of potential investors pause. It's like the wild, wild West out there.

Please enlighten.That's really not entirely accurate. You should read more about it

What has Bitcoin earned?

What are it’s future earnings based on? How do these metrics compare to

These are questions asked about investment.

What questions are asked answered differently than buying the Euro, CAD, Yen, Kroner?

Edit: No worries. It’s something. I’m in enough I need a cold wallet for.

Last edited:

uitar99

Well-known member

Yes sir! You've stayed in for 15 years and done darn well for that group of countries.I share your sentiment. Maybe I’m old or too risk adverse but I’d have a hard time putting any meaningful amount of my retirement nest egg in bitcoin. I’m with Buffett on this one. I’d be happier and sleep better with 50% of my nest egg in Brk.b than 5% of it in Bitcoin or other Cryptocurrency.

I still have too much in the FAANG stocks but they have done so well the last 15+ years it’s hard for me to not like them.

If you are Joe/Jill average investor/saver, where you invest the dollars you are saving usually follow a few simple ideas.

Age: The younger you are, the greater risk you can take, because you have more years left to recoup market downturns. (A loss only happens when you sell at a lower price than you paid, lol)

Risk Tolerance: Thats personal to you. Can your stomach handle losing $5,000 overnight? Are are you able to put that $5,000 into some wastewater treatment plant in some unknown continent country you can't spell which promises a $1,000,000 return or most likely nothing

Invest regularly: The overall price will even out as you buy through the troughs and highs.

Having a goal: If you invest, when do you know you have achieved the goal. Considering the interest rate environment today, is a goal some multiple of todays rates ie if you can get 6.5% in a bank term deposit, perhaps 13% or 19.5% is your goal. But when you achieve it, don't wait for it to fall to 2%. If your goal is to retire in (pick your place here) and you have saved your 3.5 million goal and you are 63, planning to stop work at 65, cash in. You could lose it all in two years.

But many folks just day trade, hoping for a home run, based on the news/word of mouth/Internet forums. Home runs are like winning the lottery or making the NFL, ain't gonna happen to most of us.

uitar99

Well-known member

Great question. I suppose one answer is: it earns nothing. Because its is not selling anything.What has Bitcoin earned?

Again, if you are day trading looking for a home run

Just understand what you are investing in.

The fact that bitcoin is just currency with limited conventional acceptance and no central control, increases its risk as an investment. The fact that it isn't controlled, does not make it more attractive...unless you are using it to purchase illegal products or services. and even that is a very limited customer/seller base.

Another key is starting young and invest in a fund/equity with low fees like the S&P 500 fund. My companies 401k plan charged .04% annually for that fund and I had most of my 401K invested there for 20+ years.Yes sir! You've stayed in for 15 years and done darn well for that group of countries.

If you are Joe/Jill average investor/saver, where you invest the dollars you are saving usually follow a few simple ideas.

Age: The younger you are, the greater risk you can take, because you have more years left to recoup market downturns. (A loss only happens when you sell at a lower price than you paid, lol)

Risk Tolerance: Thats personal to you. Can your stomach handle losing $5,000 overnight? Are are you able to put that $5,000 into some wastewater treatment plant in some unknown continent country you can't spell which promises a $1,000,000 return or most likely nothing

Invest regularly: The overall price will even out as you buy through the troughs and highs.

Having a goal: If you invest, when do you know you have achieved the goal. Considering the interest rate environment today, is a goal some multiple of todays rates ie if you can get 6.5% in a bank term deposit, perhaps 13% or 19.5% is your goal. But when you achieve it, don't wait for it to fall to 2%. If your goal is to retire in (pick your place here) and you have saved your 3.5 million goal and you are 63, planning to stop work at 65, cash in. You could lose it all in two years.

But many folks just day trade, hoping for a home run, based on the news/word of mouth/Internet forums. Home runs are like winning the lottery or making the NFL, ain't gonna happen to most of us.

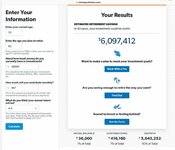

I sat my daughter down 18 months ago when she started her first real job after college graduation and explained to her why she needed to save 16%(13% for her because of her company match) and never withdraw from it until she retires. She already has some saving because my wife and I gifted her some stocks as a tax avoidance strategy. Here how things calculate for her assuming her $65,000 salary never changes in the next 40 years. In reality her salary will go up but so will inflation so I told her let’s assume they both average about 3% and offset one another so you can think of the $6,000,000 as today’s dollars.

This is assuming a 9.4% return and the actual S&P500 performance the last 30 years is about 10.6%. If she has a spouse that also works this number would obviously double. Most could live on a $12,000,000 nest egg.

Last edited:

This is a reasonable probability.Another key is starting young and invest in a fund/equity with low fees like the S&P 500 fund. My companies 401k plan charged .04% annually for that fund and I had most of my 401K invested there for 20+ years.

I sat my daughter down 18 months ago when she started her first real job after college graduation and explained to her why she needed to save 16%(13% for her because of her company match) and never withdraw from it until she retires. She already has some saving because my wife and I gifted her some stocks as a tax avoidance strategy. Here how things calculate for her assuming her $65,000 salary never changes in the next 40 years. In reality her salary will go up but so will inflation so I told her let’s assume they both average about 3% and offset one another so you can think of the $6,000,000 as today’s dollars.

This is assuming a 9.4% return and the actual S&P500 performance the last 30 years is about 10.6%. If she has a spouse that also works this number would obviously double. Most could live on a $12,000,000 nest egg.

View attachment 9218331

I don't know how many 22yo, leave 40yo, do invest $867mo post tax. (10% pre tax on a 100k salary, 15% post tax)

I'm not going to touch work retirement eligibility. That's frequently "unconscious" money flowing to the market. And that's how it's marketed.

I'm an investor, not a trader, and have been lucky enough to build the same for my daughter (11) at his point.

WOW !! this was one of my better ideas $$$$$Some altcoins have not followed bitcoins rise in the past month. I believe they will rise in value slower than bitcoin but will offer some nice gains in the near future "if" bitcoin etf's become reality. I am buying 16 different coins this morning.

I am keeping my crypto on an exchange the way it is but will be investing some additional funds into an ETF soon. I am hoping Fidelity will be competitive on the fees because that is who I am comfortable with.Spot bitcoin ETFs were finally approved by the SEC and begin trading today. 11 applications from the likes of fidelity, invesco, blackrock(ishares), ark, vaneck, franklin, grayscale, etc

I've read most are waiving fees for 6-12 months but with a capI am keeping my crypto on an exchange the way it is but will be investing some additional funds into an ETF soon. I am hoping Fidelity will be competitive on the fees because that is who I am comfortable with.