Acesteve

Well-known member

Another option for funding retirement accounts for your kids, especially if they are not yet out of college and have a decent income, is to gift them stocks that you have held for a long time that have a low cost basis. You avoid paying the 20% Federal capital gains plus whatever state income taxes(9.85% in MN). Our children inherit the cost basis of the stock but the first $44,625 of income is exempt from capital gains so they can sell the stock and convert it into an index fund and not pay any taxes vs our tax rate of about 30%.

The maximum gift until you have to pay taxes is $18k each/$36k per married couple.

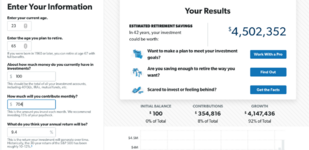

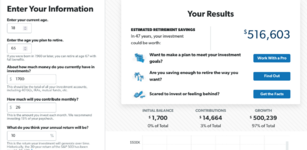

about 5 years ago I decided my retirement savings was suffecient so I shared with my childern that I would fund there ROTH IRA to the amount they made in a given year. I was not thinking wealth transfer rather teaching and the joy of savings. If I drop 6k into an account, I invest 500/month into an index fund and I have them look at the account balance that mindless emotionless investing has on them once a year. I want them to think this vs chasing hype cycles like they can beat the market long term. No, you can't beat markets long term but you can squander your money and you don't need to do any of this. I don't need to hit a driver on a 124y par 3 either even if it will go further

as I've continued to work, now I look at these funds a a portion of wealth transfer. I'd rather them grow into managing money then just inherit it then blow it on things that don't matter.

ps. and the stock transfer thing is great for those that own stock vs mutual funds! another great teaching tool in that they simply need to hold it even if they take the dividends as income