Other factors related to age are health insurance and that most people spend more in earlier years than later years. Health insurance is freaking expensive until you are Medicare eligible. Also, I learned that each spouse has to individually be age eligible.I saw something on TV that caught my attention. I was shaking my head, yes. It relates to how people talk about retirement. Camp 1 talks about having enough money to last. Camp 2 talks about making memories. The point being that you want to be in Camp 2 as it implies money is not a barrier nor is not working the goal but rather doing things and having fun. This implies plenty of money.

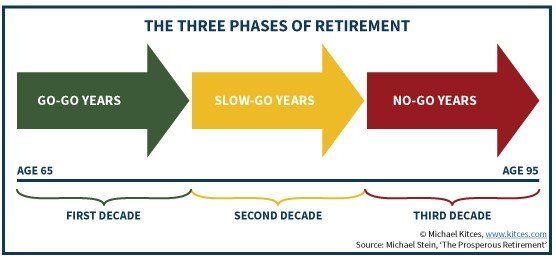

Age I don't recall being mentioned but I believe is a factor that needs to be balanced. Leave too early and with marginal savings and you might get bored. Leave to late and you may not have a body capable of fun even if you have the means.

for me the factor came down to my youngest going to college. the house is empty come september so allows my wife and i to create a new chapter

Last edited: